In this article, we write on insights and best practices from our workshops and surveys around the finance and insurance industry.

The following challenges are emerging in this sector regarding the future workforce:

- 41% of Future Workforce stated that they had no knowledge of insurance products at all.

- According to the survey, 40% of respondents cannot imagine working for an insurer in the future. The insurance industry as an employer therefore does not look particularly attractive overall.

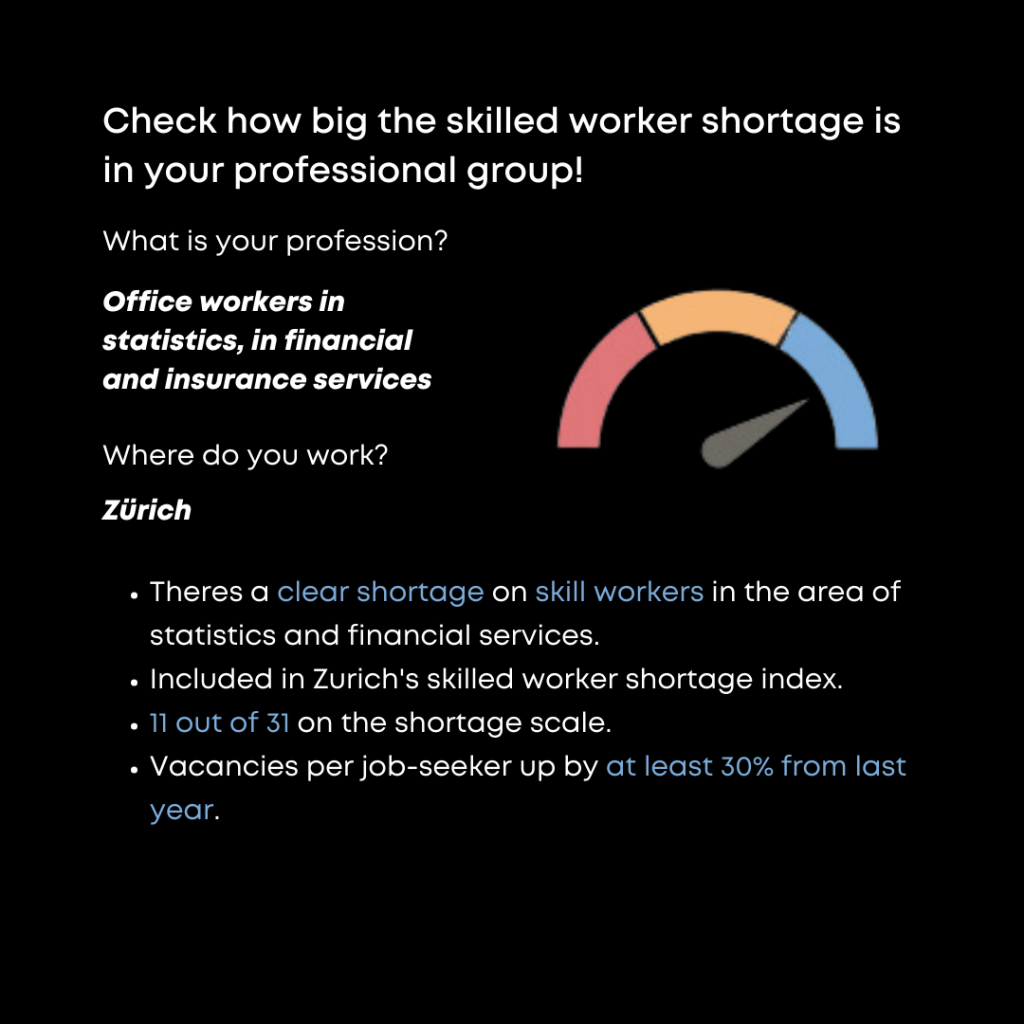

Based on Switzerland’s skills shortage index, there is a significant shortage of office staff in the finance and insurance sector in Zurich, but less so in the Espace Mittelland (see statistics below).

These challenges call for action. For companies in the insurance and financial sector the following actions can help:

- Defining and sharpening the company’s purpose and living it within the company

- Educate, educate, and educate again! It is essential to educate the younger generation about the services and the industry.

- Further development of digitalization: Generation Z wants to be reached primarily via digital channels and wants to have less initial contact with an agent.

In our mandates and workshops with financial and insurance companies, we repeatedly realize how important it is for the future workforce to have a clear purpose that gives them meaning and orientation in their work. As we reported in our blog (link construction blog), meaningful work is central to the younger generation, especially in an industry that is not the first choice of the future workforce.

However, the insurance career is more interesting than expected because:

- 41% can imagine a career in the insurance industry

- 33% would consider a career in insurance but only as a second choice

- 62% a good income is essential

- Job security is key for 55%

- However, meaningfulness is most important at 77%

It is therefore crucial for insurance companies and financial service providers to emphasize job security and to take targeted measures to develop young talent so that they stay for the long term. All under the paradigm of: Retaining existing talent instead of constantly looking for new talent. This starts with the apprentices and extends to the young executives and future managers.

At Kitoko People, we help to understand, develop and retain the future workforce. Interested? Contact us or subscribe to our newsletter.

Sources: